.

Summary

A central bank cross-border liquidity line is an agreement between two central banks to provide a collateralised loan of currency from one to the other. They have been around for a long time, but have risen in prominence since the global financial crisis. This dataset provides a comprehensive (to the best of our knowledge and ability) repository for all lines in place since 2000. This dataset was collated from public sources, so it can be freely used by other researchers.

The dataset will be updated regularly to reflect the latest data.

- Vintage 1: The dataset was last updated in May 2024 to cover lines in place until December 2023.

- Vintage 2: The dataset was last updated in January 2025 to cover lines in place until December 2024.

- Vintage 3: The dataset was last updated in January 2026 to cover lines in place until December 2025.

Authors and Reference:

The Global Network of Liquidity Lines (2024), CEPR discussion paper 19070. bibtex

- Saleem Bahaj

- Marie Fuchs

- Ricardo Reis

- Acknowledgments: Marina Feliciano, Seyed Mahdi Hosseini, and Xiaotong Wu provided excellent research assistance.

Full Dataset

Download in three formats:

Variables

The data is at the agreement level: by date and duration (2000-25), by source currency (USD,EUR, RMB, others), by type (bilateral or multilateral), by funding structure (pooled or by individual bank), by counterparties (central banks), and by some terms (like collateral).

| Column | Description |

|---|---|

deal_ID |

Unique ID for each row representing a deal |

deal_type |

String indicating reciprocity type |

framework |

String indicating if deal is part of larger framework agreement |

reciprocal_deal |

If deal is reciprocal, numeric value indicating matching reciprocal deal |

collateral |

String indicating type of collateral underlying each deal |

ISO_source |

Source country ISO 3166-1 (alpha-3) country code |

source_country |

Source country name |

ISO_recipient |

Recipient country ISO 3166-1 (alpha-3) country code |

recipient_country |

Recipient country name |

start_date |

Agreement signature date or press release date |

end_date |

Agreed expiration date as mentioned in press release |

existence_previous_deal |

Indicator variable for whether a deal of any kind existed between the two countries in the past |

deal_action |

String variable indicating the role of each deal within a deal chain |

previous_deal |

(Backward-looking) if deal_action renew or reactivate, previous_deal indicates prior deal of identical characteristics being renewed or reactivated |

currency_of_deal |

Agreed currency of the deal (ISO4217 standard abbreviation) |

source_currency |

Source central bank currency (ISO4217 standard abbreviation) |

source_currency_deal |

Dummy variable if deal and source are same currency |

deal_currency_amount |

Quoted maximum amount agreed on in currency of the deal; registered in billion as mentioned in press release |

USD_amount |

If deal amount mentioned in USD in press release, then USD maximum amount, otherwise NA |

unlimited |

Indicator variable for whether deal amount was unlimited |

initiative |

Initiative under which deal was agreed (if any) |

Latest Figures

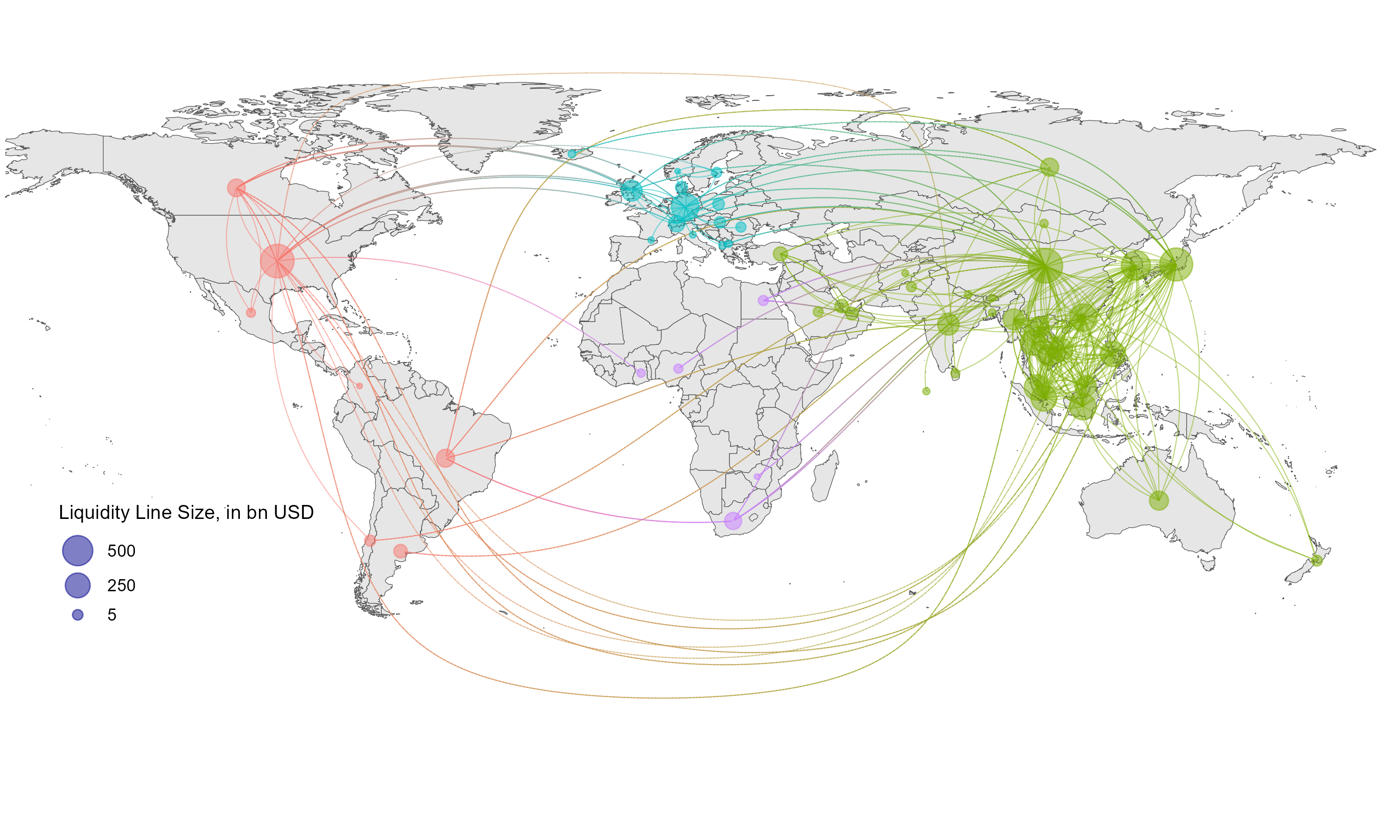

Geographical coverage of the liquidity lines (as of 2023)

Data for replication: Excel, csv, dta

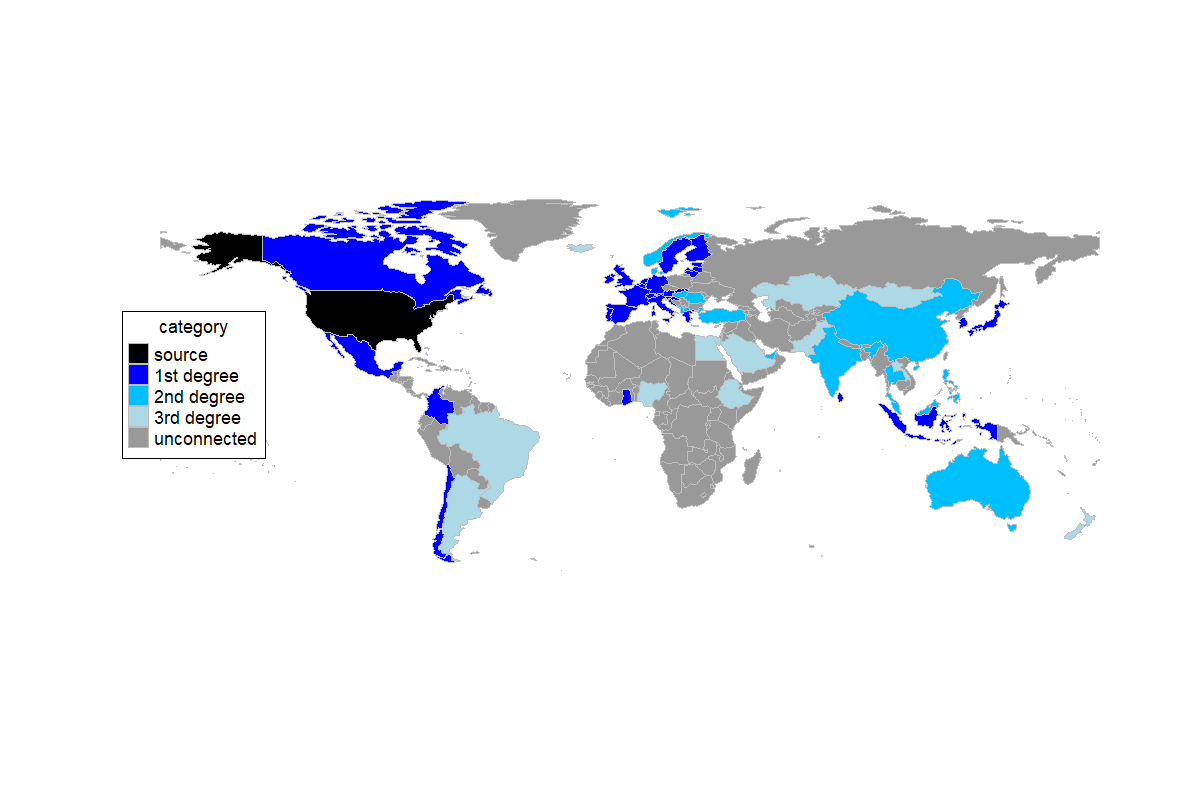

Geographical coverage of the USD bilateral liquidity lines by degree (as of 2025)

Data for replication: Excel, csv, dta

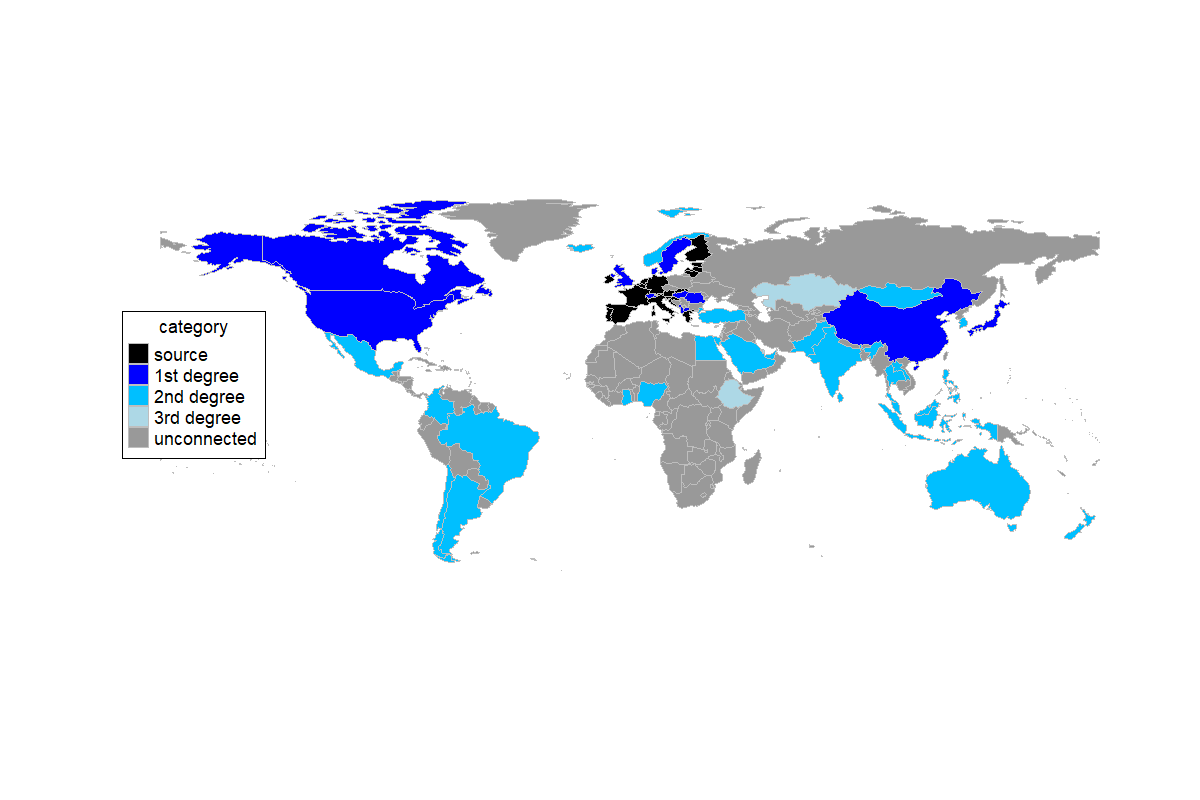

Geographical coverage of the EUR bilateral liquidity lines by degree (as of 2025)

Data for replication: Excel, csv, dta

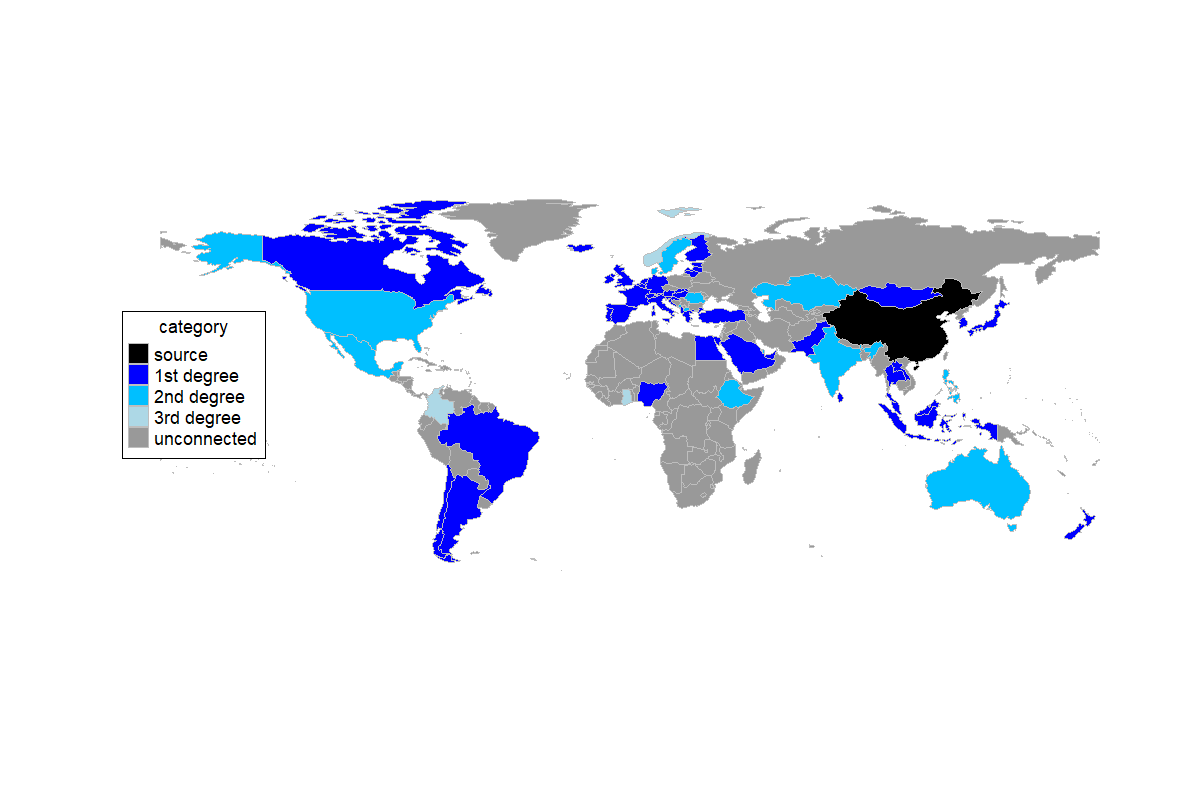

Geographical coverage of the RMB bilateral liquidity lines by degree (as of 2025)

Data for replication: Excel, csv, dta

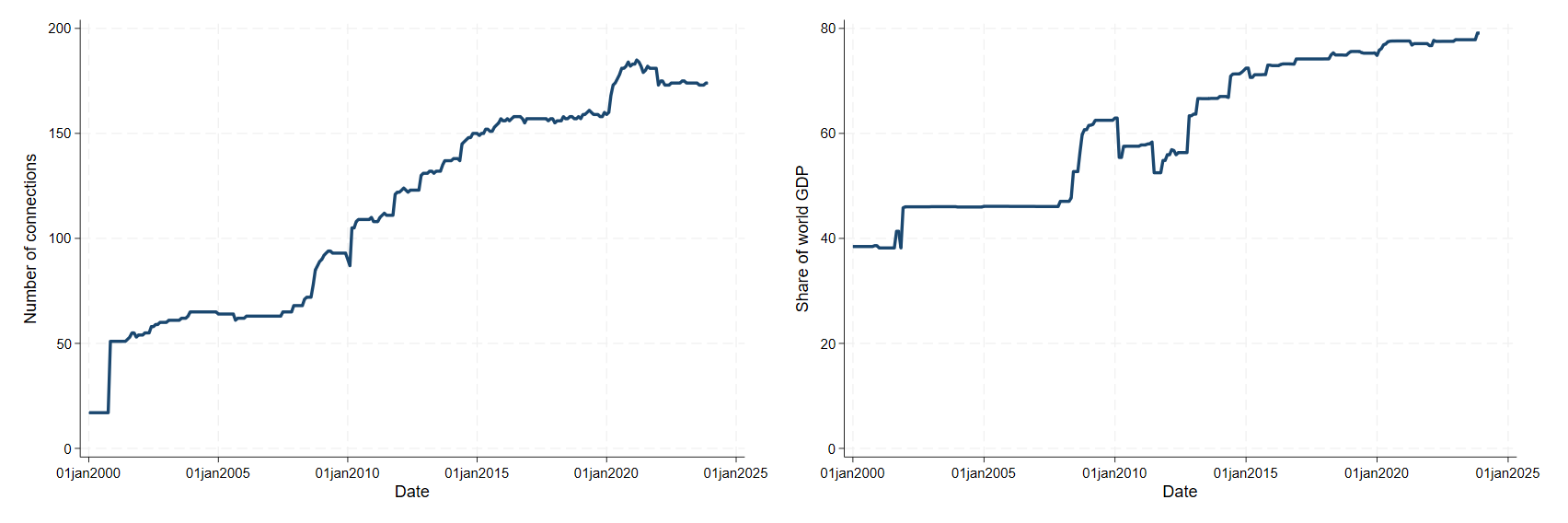

The evolution over time of the liquidity lines (as of 2025)

Data for replication: Excel, csv, dta

Data for replication: Excel, csv, dta

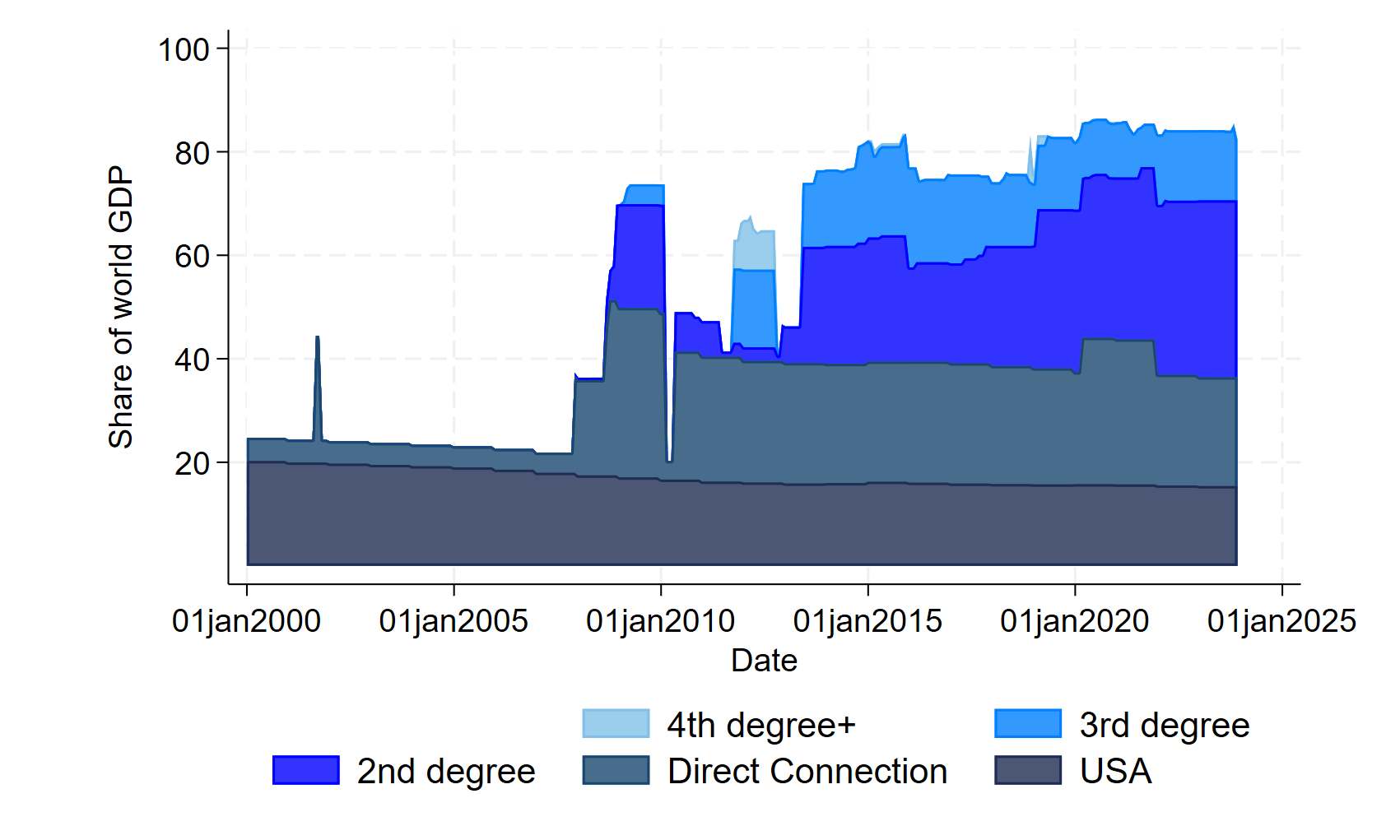

The evolution over time of the USD bilateral liquidity lines (as of 2025)

Data for replication: Excel, csv, dta

Data for replication: Excel, csv, dta

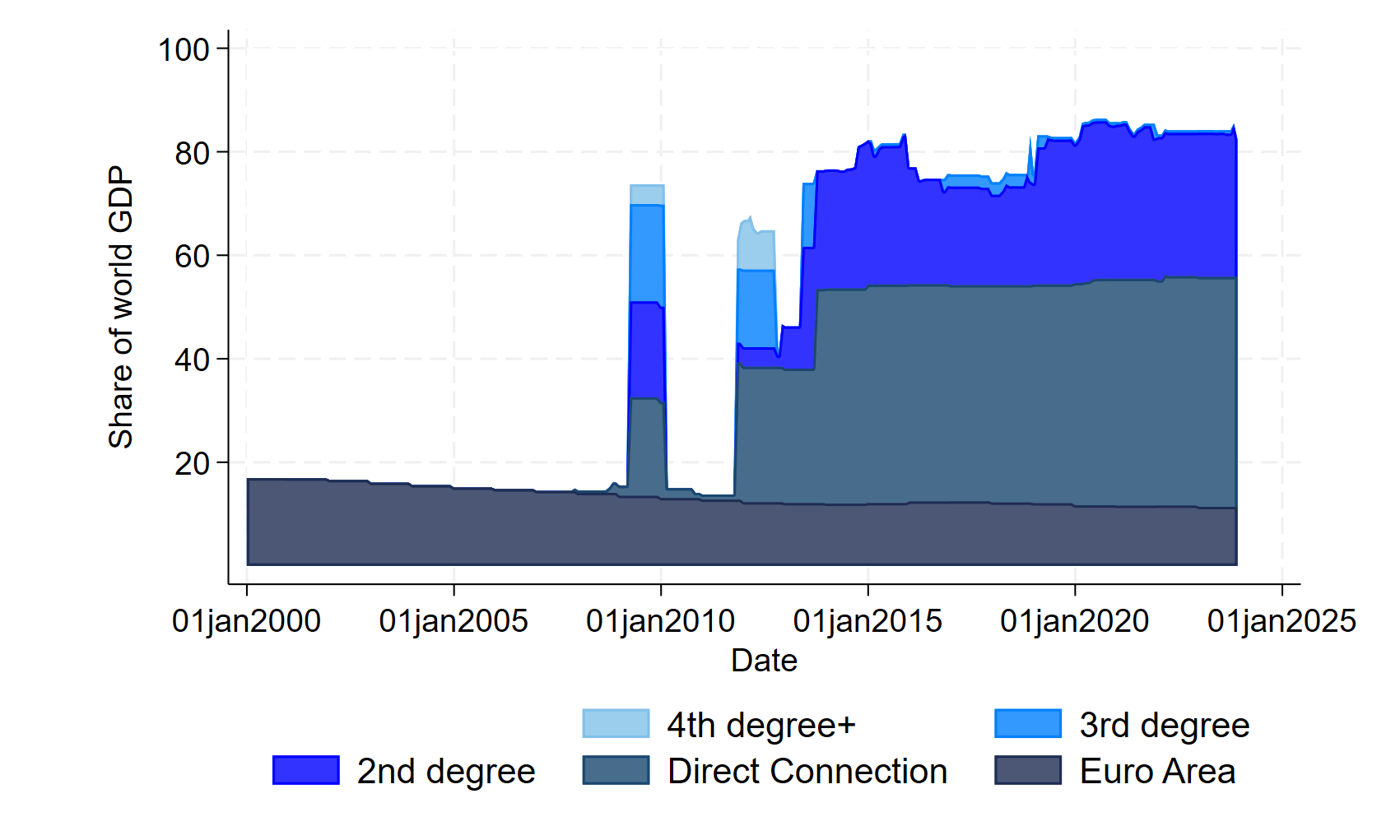

The evolution over time of the EUR bilateral liquidity lines (as of 2025)

Data for replication: Excel, csv, dta

Data for replication: Excel, csv, dta

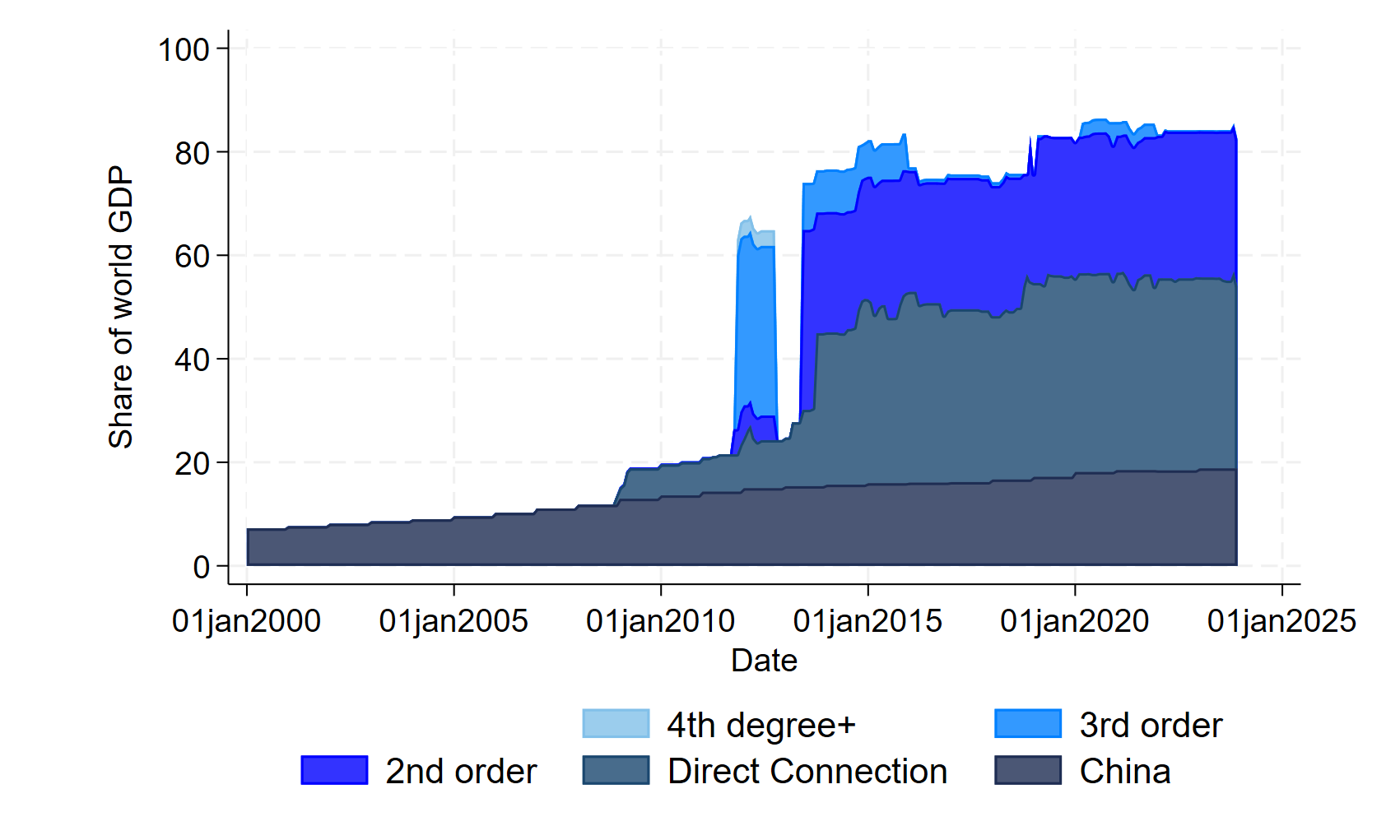

The evolution over time of the RMB bilateral liquidity lines (as of 2025)

Data for replication: Excel, csv, dta

Data for replication: Excel, csv, dta

Usage

Please cite if use, and e-mail the authors with suggested corrections.